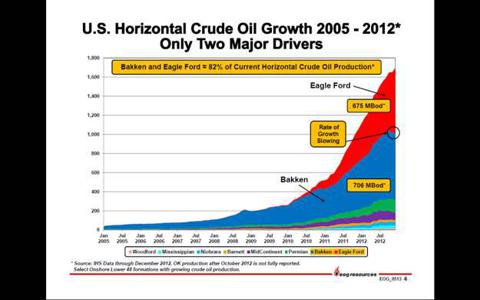

This could be a very big deal for CLR and others

Bakken: The Downspacing Revolution

Triangle Reports "No Communication" In a Downspacing Test:

On June 10, Triangle Petroleum (TPLM), a small-capitalization Bakken operator, reported its first quarter fiscal 2013 results and provided operational update. Some of the operational insights discussed by the company are quite notable. The most important is the confirmation of 160-acre downspacing feasibility in the deep portion of the Basin. The announcement may be a bellwether report which front runs a wave of downspacing test result releases by several larger operators expected later this year and in 2014.

Triangle is one of the first operators to report results of a high density drilling test in the Middle Bakken. According to the company's press release, its recent downspacing test indicates potential for 6 - 8 Middle Bakken wells per 1,280 acre spacing unit, which is equivalent to 213-160 acre density, "with no communication."

The "no communication" statement by Triangle is quite important. It suggests that there is little or no loss in well productivity and economics due to tighter development spacing. The positive downspacing resolution, if confirmed by further production history and tests by other operators, could essentially double well inventories in the most productive areas in the play, translating to significant economic value.

While many operators have initiated downspacing pilots, specific results in the majority of cases are yet to be reported.

Continental Resources (CLR) deserves credit for coming forth, almost a year ago, with a high conviction view that high-density development patterns may be feasible in the Bakken with potentially little or no communication between wellbores. Continental has initiated an extensive pilot program to evaluate downspacing potential across its vast leasehold in the Bakken. One of Continental's comprehensive pilots is designed to test 160-acre downspacing (picture below). Results from the pilot will not be available until 2014.

Several other operators, including Whiting Petroleum (WLL), Oasis Petroleum (OAS), Kodiak Oil & Gas (KOG) and Halcon Resources (HK), to name a few, have followed Continental with their own, often quite comprehensive, evaluation programs.

:

Is China Internet user growth slowing? - Seeking Alpha

Reply With Quote

Reply With Quote

Bookmarks